USDQ StableCoin

The 1st element of the ecosystem is the exchanges. USDQ bargains on the secondary market at the price of 1 dollar for 1 USDQ, respectively traders interact with this coin, as well as with any other. To buy USDQ at the exchange is the first way by means of which it is possible to get stablecoin. ( https://usdq.platinum.fund/whitepaper ).

What is special USDQ ?

The special, which contains a number of significant components of the ecosystem, is considered to be the acquisition of credit in stablecoin USDQ through crypto mortgage ownership. The Deposit amount for the purpose of issued stablecoin is D %, at which point D is the final amount determined by Q Box, which is considered a self-learning neural network and is approved by the management token holders. This way, someone comes the loan leads to ensure the sustainability of the token USDQ.

USDQ StableCoin

The 1st element of the ecosystem is the exchanges. USDQ bargains on the secondary market at the price of 1 dollar for 1 USDQ, respectively traders interact with this coin, as well as with any other. To buy USDQ at the exchange is the first way by means of which it is possible to get stablecoin. ( https://usdq.platinum.fund/whitepaper ).

What is special USDQ ?

The special, which contains a number of significant components of the ecosystem, is considered to be the acquisition of credit in stablecoin USDQ through crypto mortgage ownership. The Deposit amount for the purpose of issued stablecoin is D %, at which point D is the final amount determined by Q Box, which is considered a self-learning neural network and is approved by the management token holders. This way, someone comes the loan leads to ensure the sustainability of the token USDQ.

How does the system work?

As coins are stable in general, you don’t need to worry about the crypto price decline that is happening in the crypto market, because USDQ is a stable coin and all you need to know is that this coin can make money for you.

Maybe you still think stable coins cannot provide benefits, but USDQ gives you convenience and benefits as I will show below:

Maybe you still think stable coins cannot provide benefits, but USDQ gives you convenience and benefits as I will show below:

- Trading on the exchange

Trading USDQ on the secondary market is like any other stable coin. - Get a loan

Guarantee your crypto and easily get USDQ stable coins. After the trade is complete, simply return the USDQ with your chosen crypto reward. - Find the Q BOX

Mine Q DAO tokens, raise your own AI-based robot, which will help you make predictions.

How it Works

- USDQ is one of its kind ERC-20 decentralized stable asset

1 USDQ = $1

Right now issued 5,531,632.5042 USDQ collateralized by 1,410.582 BTC (200% collateral) - KRWQ is one of its kind ERC-20 decentralized stable asset

1 KRWQ = ₩1

Right now issued 1,169,653,205.00 KRWQ collateralized by 249.9999 BTC (200% collateral) - JPYQ is one of its kind ERC-20 decentralized stable asset

1 JPYQ = ¥1

JPYQ is coming soon - CNYQ is one of its kind ERC-20 decentralized stable asset

1 CNYQ = ¥1

CNYQ is coming soon - HKDQ is one of its kind ERC-20 decentralized stable asset

1 HKDQ = HK$1

HKDQ is coming soon - SGDQ is one of its kind ERC-20 decentralized stable asset

1 SGDQ = S$1

SGDQ is coming soon

Collateralized Debt Position(CDP)

CDPs are simultaneously used to mint USDQ and accrue the debt. The user can withdraw the Collateral Assets at any time upon repayment of the USDQ amount, equal to the loan originally received. CDPs implement the "excessive collateralization" principle, assuring that the debt value never exceeds the value of the Collateral Assets. The technique enables CDPs to dampen a negative impact from sudden price movements for the Collateral Assets.

With this project, there are Five(5) stages associated with the process for CDP Operations. These stages is discussed below.

- Stage 1: CDP Creation

The user registers at Q DAO Platform. The user needs to specify only the email, so that the ecosystem can furnish notifications on important events. In this way, we assure a high level of anonymity. The user receives the wallet and 3 private keys (private key to user's BTC wallet, private key to our network and private key to Ether network (with the last key provided optionally)), used to access various functions within the ecosystem.

- Stage 2: CDP Activation

The user transfers a required amount in BTC to their BTC wallet within the Q DAO Platform. Then, the user sets the desired parameters for the loan to be obtained.

- Stage 3: USDQ Generation

The ecosystem checks the availability of the required amount of the collateralized assets (for instance, Bitcoins, which the user has previously collateralized within the system). Upon a successful completion of the verification, the ecosystem mints the respective amount of USDQ and furnishes the same to the user's wallet. Now the user can utilize the received stablecoin as he wishes.

- Stage 4: Equilibrating Collateral

Subsequently, the user can adjust the collateral depending on the changes to the collateral price. Should the collateral's price go down, the user must add up the collateral or repay a portion of the USDQ-denominated loan. If the user fails to take any action, the ecosystem will perform the forced liquidation process. Should the collateral's price go up, the user can increase the USDQ-denominated loan amount, withdraw a portion of the collateral or avoid taking any action at all.

- Stage 5: Withdrawal

The user furnishes a request to the ecosystem for the funds withdrawal. The user should repay to the ecosystem the earlier received USDQ-denominated loan and the Stability Fee, which accrues throughout the loan term and payable in Q DAO token. The user utilizes the private key in order to sign the transaction, enabling the user to get the collateral assets back to his wallet.

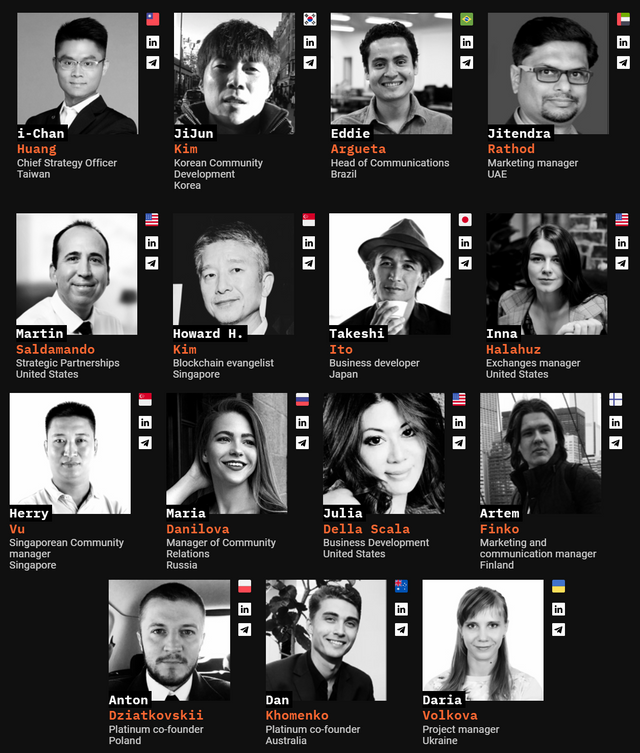

Management team

information

Author : apkt

Eth : 0xCca43963a2d2b45878ac204A8c7275D817acbA52

0 komentar:

Posting Komentar